Managing your company’s expenditure in today’s world is a challenge, and insurance can often seem like an area where costs could be cut to save money.

However, as highlighted in Aviva’s latest Risk Insights Report, high inflation, supply chain disruption and labour shortages are impacting the amount businesses need to insure themselves for. As well as properties being at risk of being underinsured, another area that has come to the forefront is business interruption insurance.

The impact of being underinsured

If you’ve thought about the cost of rebuilding and reinstating your business, how long do you think it would take to get all of that building work agreed and completed, and your equipment ordered and installed?

What about how long it will take to rebuild your customer base to pre-event levels?

This is where having the right level of business interruption (BI) cover for your company is extremely important. The time it takes for your business to get back to normal following an event that causes interruption is known as the “period of indemnity”. Calculating this correctly can help protect your income and cash flow during a period of down time when your business can’t operate. It can often take longer than you might think to bounce back.

For example, if your company premises were destroyed by fire, factors such as planning permission and building inspections could easily add to the timeframe to rebuild. And that’s before you think about the current supply chain issues which are particularly prevalent in the building and construction sector.

What if a piece of specialist equipment breaks down or is stolen. How quickly could that be replaced? Can you operate without it?

If your BI limit isn’t adequate, you may not be able to cover the full estimated loss of earnings during a period of reinstatement, leaving you financially vulnerable.

BI underinsurance and claims

When those rare events do occur and a large loss is experienced, perhaps a total loss of stock, equipment and premises through a fire or flood, the issue of underinsurance comes to the fore.

There are typically shorftalls in the property rebuild costs and replacement of equipment or the indemnity period is too short to support the business through the recovery process back to normal operations.

This picture is compounded by current economic pressures, with high levels of inflation pushing up costs across the supply chain, driving higher replacement and materials costs.

Supply chain disruption not only raises costs but often results in difficulties acquiring both standard and specialist parts, causing delays in recovery and extending the time through which a business is unable to operate.

Labour shortage issues can also cause significant delays when specialist skills are not available at short notice or in line with project planning, increasing the amount of time a business needs to be covered under its business interruption policy.

What are the consequences?

When you’re considering what being underinsured could mean for your business, think about the wider impacts, not just the shortfall you might have to pay:

- Production delays

- Employee wellbeing issues

- Cash flow problems

- Loss of revenue

- Supply chain problems

- Impact on share price

- Loss of key employees

- Disappointed customers

- Reputational damage

Can your business afford any of these?

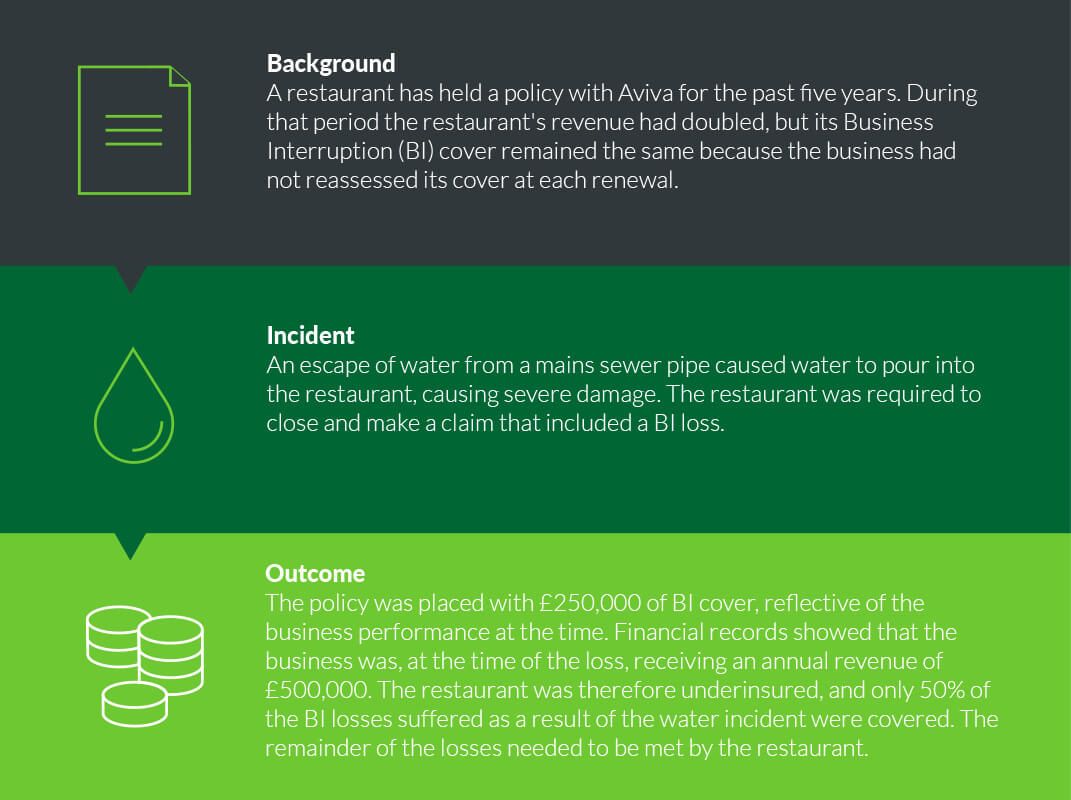

BI claim – an example

Let’s take a look at how being underinsured for BI cover could play out.

Building resilience

Unexpected interruption to your business can be caused by a range of events.

It can be difficult to stay on top of the market conditions that could affect your insurance policy – such as labour shortages, rising material costs, or wider supply chain issues.

Regular conversations with your insurance adviser can help you understand how much cover you need and keep things up to date.

Things like new plant and machinery, property alterations and inflated stock levels can impact the level of cover required.

Business interruption insurance should form part of your risk management programme. Organisations that recover successfully will also have a detailed Business Continuity Plan (BCP) and recovery procedures in place.

To find out more, or to review your current BI cover, get in touch.