Cyber Insurance

What is Cyber Insurance?

Cyber insurance, unlike more traditional risks posed by physical catastrophes like fire and flood, exists to protect businesses against the digitised threats of the modern world.

Challenge

Cyber-attacks occur in many different forms, from data breaches to human error. They cause major disruption to your life and your business, including operational downtime, financial loss, reputational damage, regulatory investigations and legal action.

Support

Our team of cyber risk advisers work closely with our clients and understand the sectors in which they work. We’ll help you get a handle on your cyber risk exposure, giving you the tools to manage the cyber risk to your business and deal with the worst-case scenario.

Perform

We work in partnership with you to understand your business so that we can diagnose your cyber exposures and provide truly bespoke risk protection advice that is relevant to you. Taking the time to understand what cyber risk looks like in both your industry and your organisation. Using insights to build a tailored insurance and cyber risk management programme.

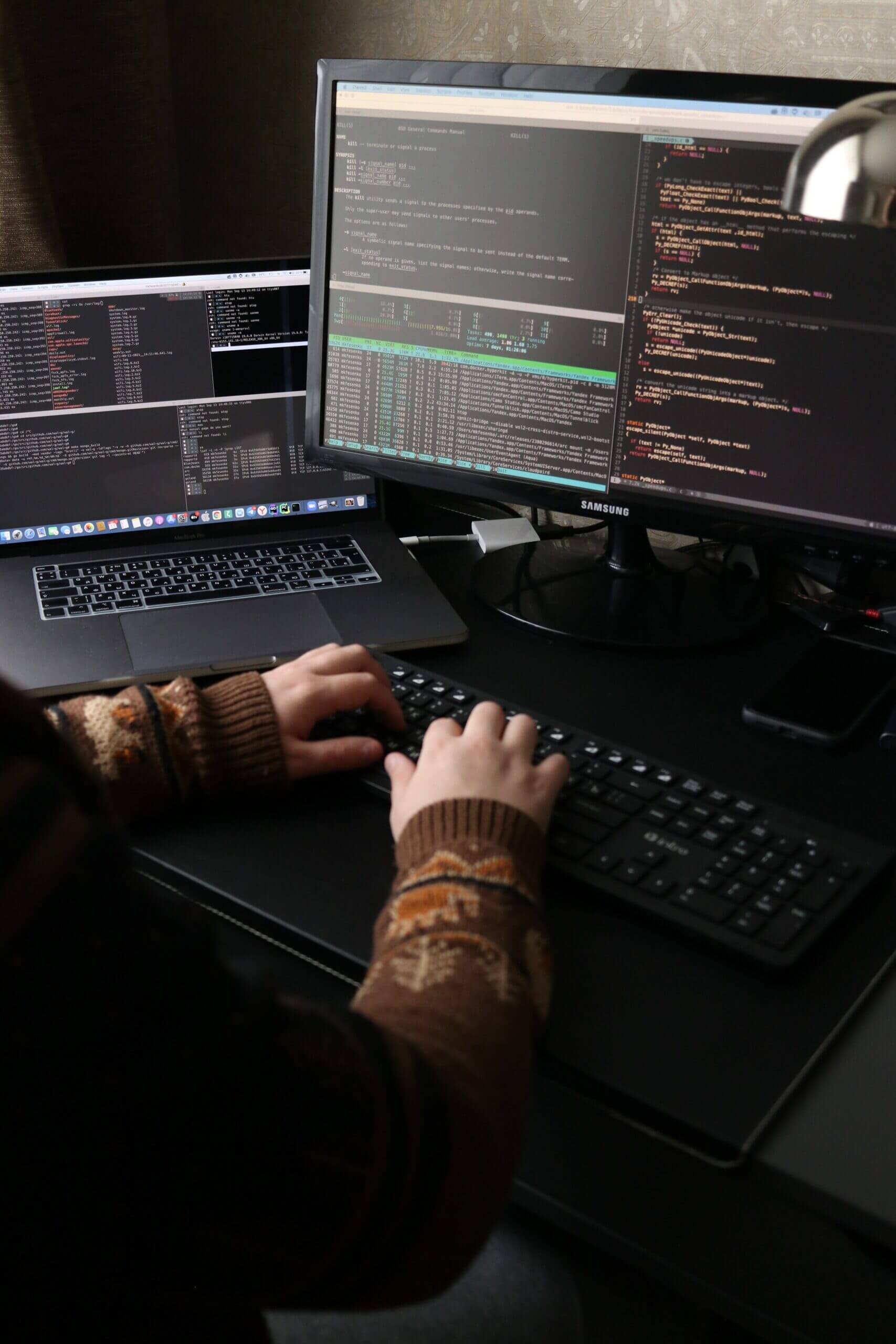

How long could you trade without access to your systems and/or data?

In the event of a data breach or malicious cyber attack that could interrupt your business , cyber insurance can provide the critical support needed to get back in business . Whilst still a relatively new concept to many, cyber risk now ranks as one of the top threats companies fear most.

Research suggests that the average cost of a fire per incident has been calculated as £657,074.

The average total cost of a data breach in 2022 was over £3.4m.

Whilst most businesses wouldn’t dream of going uninsured for fire damage, due to lack of understanding of the current and present cyber risk that exist, it’s estimated that fewer than 10% of UK SMEs hold cyber insurance.

Almost a third of UK firms reporting at least one cyber-attack in the past 12 months, yet despite this only 19% of businesses in the UK have a formal response plan6 to deal with a cyber incident. As technology continues to evolve it has never been more important to understand and protect your business against cyber risk.

Why do you need Cyber insurance?

Cyber insurance is designed to protect your business against the losses associated with damage or breach of information from your networks and IT systems. It can cover a range of costs from managing the incident management and restoring your system and to protecting your income . Your cyber policy provides the peace of mind that, if you were to be a victim of a cyber crime, you would have the financial assistance and support necessary to get your business back on its feet.

Other benefits can include:

- Cyber vulnerability reports

Provide visibility of your cyber threats and explains how to mitigate them - Real time monitoring

Continuous scanning of your digital estate, with real-time threat alerts: helping you resolve problems before they result in loss

- Scenario-based cyber awareness training for staff and Boards

Turning your weakest link into your first line of defence

- Simulated real-life hacking scenarios with penetration testing and phishing attacks

- Actionable advice on how to protect your business with tailored security recommendations

- Cyber Essentials & Cyber Essentials+ certification

- Support to ensure compliance with current regulations

- Cyber resilience reviews of acquisition targets

Our Ecosystem

Common types of cybercrime

Cyber-attacks occur in many different forms, from data breaches to human error. They cause major disruption to your life and your business, including operational downtime, financial loss, reputational damage, regulatory investigations and legal action.

5 common types of cyber-attacks:

Attacks designed to trick you into doing the wrong thing like clicking on a malicious link, revealing sensitive information, or unwittingly transferring funds to cybercriminals. The hackers may impersonate someone within your company or contacts.

Hackers will force your computer systems to shut down or illegally encrypt your vital data and demand a ransom for it’s safe release back to you.

Where cybercriminals compromise digital devices and networks through unauthorised access to an account or computer system. Once they’re in, hackers can steal or sell your data.

These attacks aim to overwhelm a network, system, or website with excessive traffic, making it inaccessible to legitimate users. DoS attacks are carried out from a single source, while DDoS attacks involve multiple compromised computers (botnets) attacking simultaneously.

APTs are long-term, targeted cyber attacks that involve sophisticated techniques to gain unauthorized access to systems and remain undetected for extended periods.

Who needs cyber insurance?

Cyber insurance, data and privacy liability and cyber risk management may seem like things only big corporations need to worry about, but the truth is individuals and businesses of any size can suffer a cyber incident.

Who needs cyber insurance:

Individuals suffer cyber-attacks too. Jargon and buzz words are switching people off to the threat of cybercrime but identity theft, phishing attempts and financial loss are very real risks you could be facing.

From websites and email to smartphones and backend data systems, almost every business uses some kind of digital element to trade. Small businesses are becoming increasingly attractive to cybercriminals. We work with you to build your businesses resilience to cyber-attacks.

Cybercrime is on the rise. Almost a third of UK businesses report at least one cyber attack in the past 12 months. As the digital landscape evolves, we can help you to understand the cyber risks you could be facing.

Cybercriminals can find out about you and your family through digital devices, online shopping and smart home technology. Working with you to understand your family’s cyber risk, we can help you protect the things you love.

Choosing the right cyber insurance policy

When considering the right cyber insurance for your business our Cyber Director, Matthew Clark shares his top tips:

The breadth, depth and quality of response services makes all the difference should you be faced with a incident of your own.

Partner with providers that offer more than just post-incident provision. Market-leading insurers often offer policyholders a whole suite of services such as in-depth training and ‘always on’ pro-active monitoring – altering organisations to attacks in real-time. Helping to prevent incidents before they occur.

Although not 100% indicative of the quality and service, usually, those who have been in the space for longer have made more significant investment their understanding of cyber risks and have greater experience dealing with incidents/ claims.

Get on the front foot with robust cyber security. It’s far easier to embed good cybersecurity practices into your business before seeking insurance – this will make you more attractive to an insurer and enable negotiation of broader coverage and better terms.

At Partners& our aim is to help you better understand your risk exposures working with you to identify any dangerous gaps or expensive duplications in your programme, ensuring you understand the insurance you have and why you have it. A seamless approach to risk management, insurance and claims ensures you receive the most efficient and effective risk protection solution.

Usual types of cover

We focus on businesses and individuals to provide them with the right advice about cyber risk. No two organisations are the same. We take the time to understand what cyber risk looks like in both your industry and in your own organisation. We use these insights to build a tailored insurance and cyber risk management programme.

The costs involved in responding to a cyber incident, including IT security and forensic support, legal advice in relation to breaches of data security, the cost of having to notify individuals whose data is lost or stolen, PR & crisis management expenses, credit monitoring and identity theft monitoring costs.

Defence against liability for violation of privacy rights, denial of service or a failure to protect data you hold – including legal representation costs and fines* arising from a regulatory enquiry. (* where insurable at law)

The cost of restoring or recreating data and hardware lost, stolen or rendered unusable following a cyber attack.

Replacing your lost income as a result of viruses, network failure or damage, hacking or cyber-crime causing ‘down-time’.

Protection against the threat of extortion as the result of ransomware, theft of data, or damage to your computer network.

Paying for the loss of money and securities following electronic fraud, corporate identity theft and social engineering scams

We’ll ensure your protected regardless of wherever you face loss or liability – whether it arises in your own network, or that of cloud suppliers and other outsourcers you are reliant upon.

Meet the cyber team