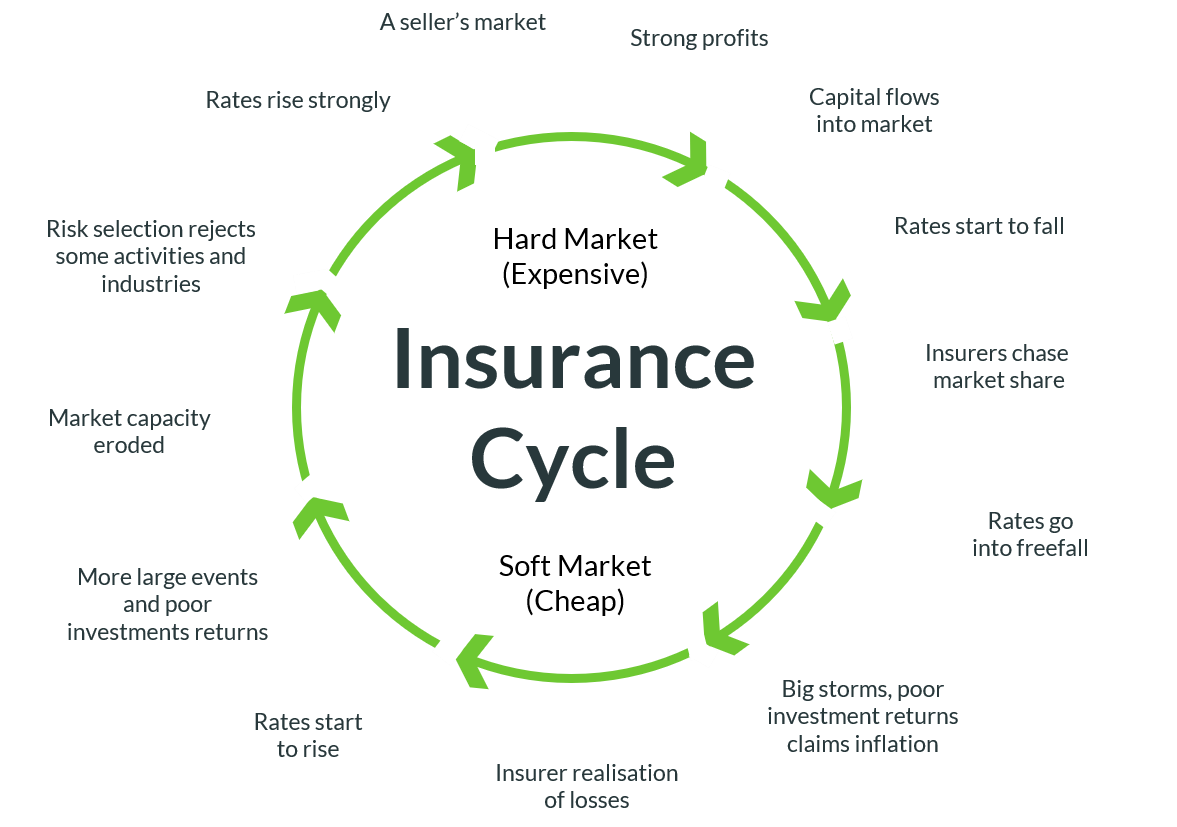

All business experience cycles of expansion and contraction, and this is particularly true of the insurance industry. Several factors influence these cycles, which are having an impact on insurance premiums.

What is a hard market vs. a soft market?

Insurance industry cycles typically last from two to ten years. After experiencing many years of a soft market, the insurance industry is now in a hard market.

Characteristics of a soft market include:

- Lower insurance premiums

- Broader coverage availability

- Relaxed underwriting criteria, which means underwriting is easier

- Increased capacity, which means insurance carriers write more policies and higher limits

- Increased competition among insurance carriers

Characteristics of a hard market include:

- Higher insurance premiums

- More stringent underwriting criteria, which means underwriting is more difficult

- Reduced capacity, which means insurance carriers write less insurance policies

- Less competition among insurance carriers.

Why are we currently facing a hard market?

A number of factors have come together simultaneously to create a hard market. From Solvency II, the Ogden discount rate, and the Bank of England’s lowest interest rates in its 300 year history, to climate change leading to record-breaking storm damage claims, low property rates leading to severe property losses and, finally, the combination of COVID-19 insurance claims, reduction in business and investment losses will cost the worldwide industry in excess of £200 billion, making it the most expensive insurance event ever.

The result: we are in the midst of rising insurance rates at a time when business risks are seemingly more prevalent than ever.

Insurers are in the business of taking risks, but given the rapid hardening of premium and terms, businesses with a strong risk management programme and a track record of low claim activity can avoid the sweeping increases of premiums and terms affecting many UK businesses today.

What you can do to minimise the effects of the hard market for your business?

- Obtain the right advice. Work with an adviser who takes the time to understand your business and diagnose your risks, so you can ensure you have the right cover to protect you.

- Take a proactive approach to risk management – such as Health and Safety, Property Protection, Cyber Training for your staff etc.

- Make sure your insurance cover is updated to reflect any changes in your business – keeping in touch with your insurance adviser is crucial to make sure you have the right cover in place – and not paying for cover you don’t need – or being underinsured.

- Avoid making claims for small losses – leave your insurance to pay out for significant events.

- Start your renewal process early and respond quickly to requests for information and documents.