Life Science Insurance

Clinical trials

If your company is involved in medical research programmes, clinical trials insurance is an essential part of your risk management package. It’s designed to provide protection for your participants as well as your business should something go wrong.

Start-ups & spin-outs

Operating a start-up business in the life science, technology, pharmaceutical, healthcare or medical devices industry is challenging. These are specialist industries with unique challenges. Having the right insurance cover in place so that early-stage research can take place is crucial.

Key Person cover

The brains behind the science can be your most valuable asset – and one that your business needs to protect. Investors will usually insist on key person cover being in place for the key individuals before committing vital funding.

Challenge

The UK life science industry is a highly specialised, fast-paced key driver of innovation and growth. It’s also global and borderless, exposing you to new risks and liabilities, often in unfamiliar places. Cutting-edge life science businesses need the right risk protection in place to safely operate at the forefront of this exciting sector.

Support

Life science insurance solutions are designed specifically to address the risk management nuances for the life sciences sector. Many off the shelf, standard or traditional policies will not provide the protection required to meet the challenges and risks you face.

Perform

Specialist life science insurance provides the protection you need – from labs, CROs, and medical devices, to health tech, pharmaceuticals and beyond. Our life sciences insurance team is a highly specialist practice, advising clients from bioscience, biotech and bioinformatics to vaccine and drug development, contract research organisations and larger pharmaceutical businesses.

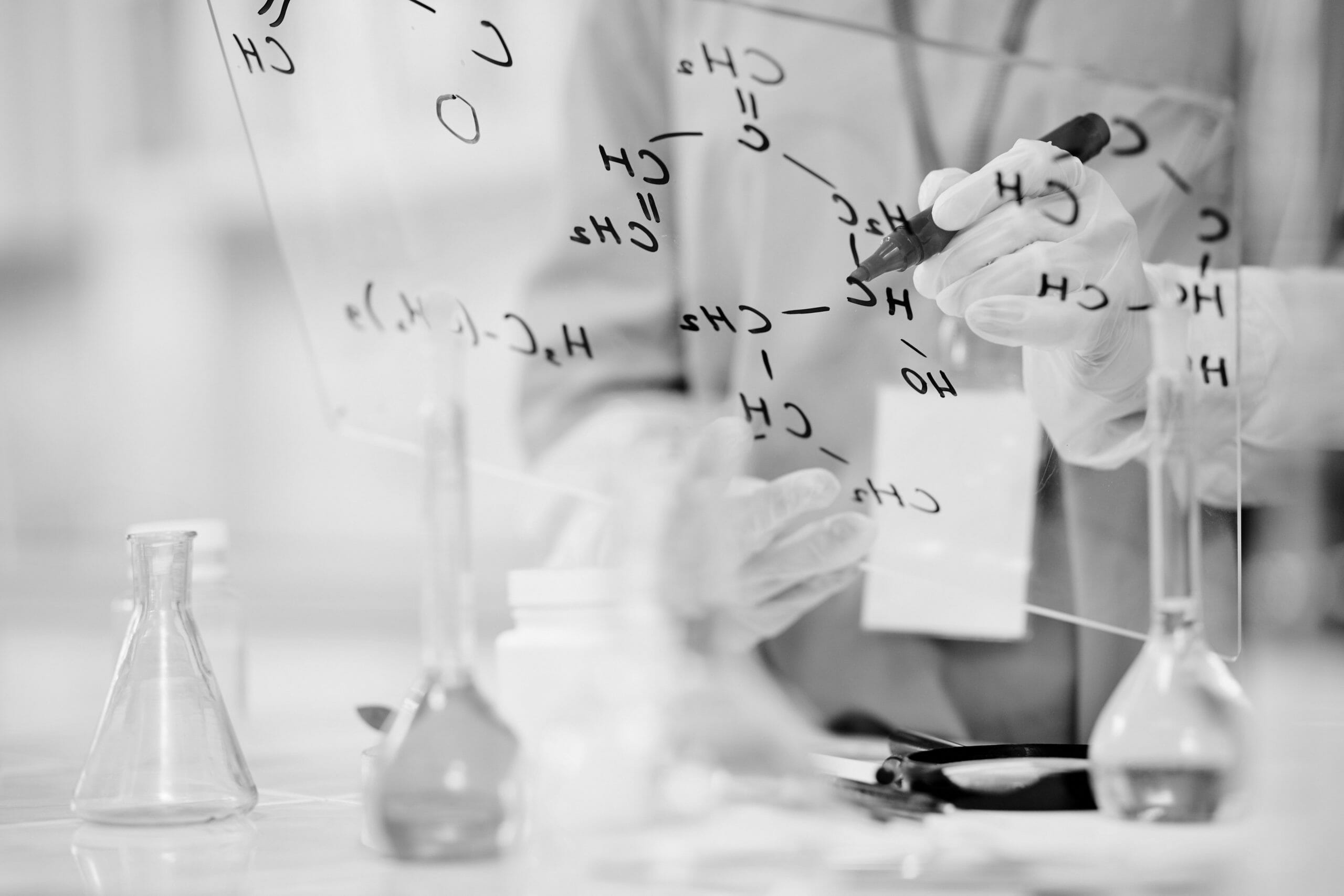

Why do you need specialist life sciences insurance?

Life science companies face unique and complex risks. They need to address the usual threats of fire, flood and theft, as well as those specific to the life sciences sector:

- Problems arising from clinical trial

- Intellectual property infringement claims

- Freezer failure and the loss of R&D materials

- A cyber-attack resulting in data theft

The life sciences industry is fast-paced, global and borderless, exposing you to new risks and liabilities, often in unfamiliar places – even legislation is struggling to keep pace.

The right insurance advice can make the difference. Does your insurance adviser really ‘get’ what you do you? Do they understand the value in your research and development (R&D) materials – the months of blood, sweat and tears invested in critical cell lines or a beautiful piece of code?

Insurance is traditionally based on precedent, but with cutting edge scientific endeavour there may be no precedent. That’s why it’s critical to work with a specialist life science insurance adviser who really understands your business model and has access to underwriters at specialist life science insurance companies and policy wordings.

Whether you’re seeking insurance for labs or clinical trials, R&D stock insurance or key person insurance for your investors, our experienced life sciences team is here to help build the stability, resilience and security to cope with unforeseen events.

Life science insurance solutions can’t prevent these events, but they can help you build resilience against the threats that you might face.

Our team of life science specialists work with our clients to ensure that the specialist life science insurance policies cater for the unique requirements operating in this field.

Public and Product Liability

Public and product liability insurance protects your business financially against damage or injury caused by a product you have supplied or by your usual business activities. Life science companies tend to face a greater liability risk in this area, so obtaining the right advice around how you can protect your business is crucial. What happens if there were a problem with a vaccine you’ve supplied or a technology failure on a medical device app?

Why is it important for life science businesses to consider public and product liability cover:

- It may be required under contracts that you sign

- Contracts may stipulate the limit you should insure for (including leases for offices/labs)

- If you travel overseas or contract with organisations outside of the EU, then worldwide cover is required, including specifying court jurisdiction

- Protecting yourself against these risks makes good business sense

Clinical trials

If your company is involved in medical research programmes, clinical trials insurance is an essential part of your risk management package. It is designed to provide protection for your participants as well as your business is something were to go wrong, and a claim is made for damages.

Life science start-ups & spin-outs

Operating a start-up business in the life science, technology, pharmaceutical, healthcare or medical devices industry is challenging – these are specialist industries with unique risks and exposures. Having the right advice and insurance cover in place to enable early-stage research is crucial.

Who work within the life science sector

Usual types of cover for the life sciences industry

With the surge in cyber risk and counterfeit drugs, the rapid Covid-fuelled digitisation of healthcare and the “war for talent”, insurance is just a part of managing risk in the life science sector. We work with our clients to provide the right advice for them, taking a holistic approach that equips them with the insight to make informed decisions.

Providing cover for your business contents, laboratory equipment, computers and work in progress.

Protection for loss of research expenditure or increased costs of working following loss or damage to your business assets.

Employers Liability is a statutory requirement and covers both your legal defence costs and legal liability to pay compensation to employees injured at work. Public Liability covers both your legal defence costs and your legal liability to pay compensation to third parties for bodily injury or damage to their property.

If your business is involved in medical research, medical devices or drug discovery, clinical trials insurance is an essential part of your risk management package.

Clinical trials liability insurance covers bodily injury (subject to policy terms/conditions) to a research subject due to their participation in a clinical trial.

Directors, company officers and senior managers can be held personally liable for the actions and decisions they make on behalf of the company. D&O can provide cover for legal advice and cover defence costs as well as any compensation costs that arise from an unsuccessful defence.

Intellectual property is an intangible business asset that often helps set companies apart from their competitors. Unfortunately, few businesses know precisely what their IP is worth, or how to protect it. IP insurance provides cover for claims alleging infringement of IP rights, including patents, trademarks, copyright and trade secrets.

Key Person insurance protects against the loss of profits that could result from the critical illness or death of a key individual (often a director or the brains behind the business), by paying out a cash sum so that the business can continue to operate.

Meet the life science team

Hanna Beaumont

Science & Technology National Practice Lead

Paul Monaco

Client Director