Financial Wellbeing

What is financial wellbeing?

Financial wellbeing refers to an individual’s sense of financial security and stability. An employee identifying with positive financial wellbeing would refer to themselves as having good financial understanding and control of their personal finances, with the financial resilience to weather unforeseen circumstances.

Factors that can impact your people’s performance can be work-related, however, they are often, if not more so, influenced by a range of more personal challenges. Whilst a seemingly personal topic, financial wellbeing at work is a key factor to managing and maintaining your employees’ overall wellbeing and productivity, as well as mitigating your organisation’s people risk.

How can Partners& support your employees' financial wellbeing

Challenge

Research has shown that financial stress is intrinsically linked to ones overall health and wellbeing, yet it remains a neglected area 1. Poor financial wellbeing affects employee health and has a direct impact on employee performance and productivity.

Support

We believe that businesses have an opportunity to support an employee’s overall wellbeing by considering financial wellbeing from three perspectives: salary, benefits package and financial education. If one thing is certain, against the backdrop of the cost-of-living crisis, financial education has never been so important.

Perform

An employer’s ability to support the financial wellbeing of their workforce is much wider than their capacity to provide monetary increases. Provisions accessible via employee benefits packages, such discount schemes and financial education can be just as beneficial to employees looking to improve their financial wellbeing.

1. https://www.cipd.co.uk/Images/health-wellbeing-work-report-2022_tcm18-108440.pdf

Talk to us about financial wellbeing

Financial education for employees

Partners&, in collaboration with our ecosystem partners Integrity365, have produced a range of financial wellbeing tools for our Financial Wellbeing Hub specifically designed for businesses to provide financial education for employees.

The suite of services aims to equip employees with tangible financial education and useful discount options on everyday spending, as well as providing the basic knowledge and understanding to make sensible and pragmatic financial decisions. We have also produced a pulse survey that will help employers gain an understanding of how their workforce feel about their own financial wellness.

The Partners& Financial Wellbeing Hub

Designed to provide financial education for employees, the Financial Wellbeing Hub features an array of dynamically delivered content for staff to engage with.

For employers looking to further enhance their benefits programme, employee discount schemes are a great way help employees’ pay packets go further and increase their overall financial wellness. Employee discounts offer a variety of savings to suit all lifestyles and are a benefit that employees find desirable, particularly in the current climate. They’re especially effective when they offer discounts for products and services that employees buy regularly.

If you haven’t considered employee discount schemes, now is the time. They are perks that don’t take a lot of work to put into action – but could have a powerful impact on your people and your business.

The Partners& Financial Wellbeing Hub includes a range of self-help tools to enable employees to take control of their finances. The Hub is updated regularly with new links and information. The aim of the Financial Wellbeing Hub is to provide your employees with a practical and useful one-stop-shop which you can access from work, home, or mobile device.

Four core videos to guide your employee to financial health:

- Money in, money out

- Controlling your spending

- Managing debt

- Savings & investments

- Monthly articles reflecting topical financial themes

- A selection of shorter videos on key areas of interest

- A section to highlight current financial scams

- Regular links to websites that provide practical cost saving advice

- Regular links to important news stories in the personal financial space

The Hub also includes signposting to the employer’s Human Resources team, existing employee benefits support, and other respected – not for profit – organisations that are best placed to assist employees with their financial worries and concerns.

Financial Wellbeing Tips

Centred around the four steps to financial health, we have produced a short series of bitesize, easy to follow videos that focus on how to:

- Manage your current financial situation

- Assess and control your spending

- Create an approach to debt management

- Understand the basics about savings and investments

These are supplemented by a variety of up to date, useful articles and videos on topics such as how to avoid financial stress, understanding your pension, common mortgage questions and general of the moment advice and guidance in an ever-changing landscape.

There is also practical support in the form of links to websites that may help control or even reduce spending, information on current scams circulating to help prevent people falling victim to any of these, and a section on help for households that directs people to the various elements of state support that could be available to them such as: financial support around household costs, childcare, transport, income, and energy bills.

Find out more

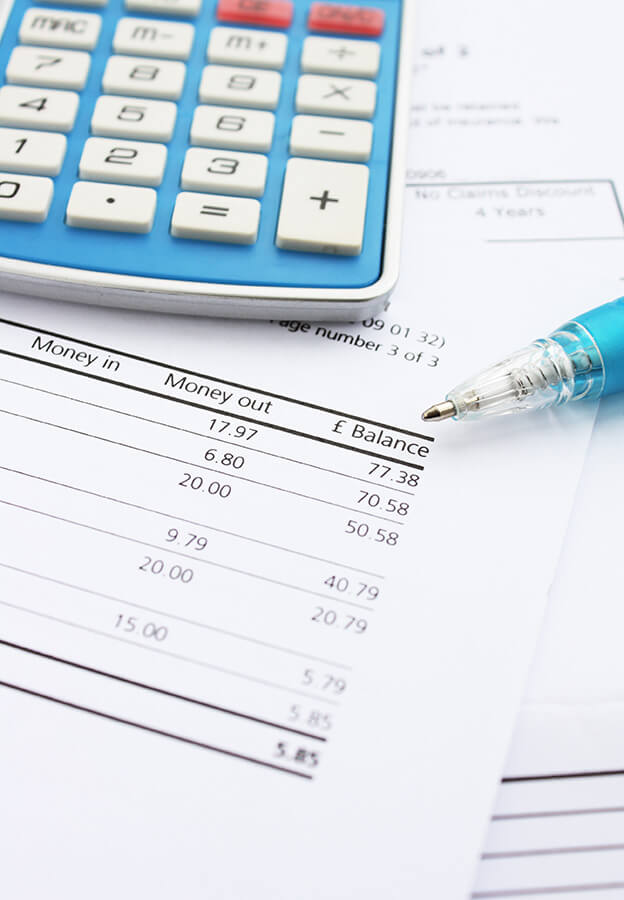

Trivial Spending Calculator

You will be amazed at how small daily spending adds up. So use the simplified calculator below to curb your small spending habits and effectively give yourself a pay rise in the process!

Employee discounts are an additional way of supporting your staff financially

Partnership is in our DNA

Our benefit consultants and advisers have in-depth knowledge of the market and focus on getting to understand our clients, so that we can provide the right advice and solutions for our clients.

As the name suggests, Partnership is in our DNA. We all share a common bond – to focus on excelling in what we do and exceeding our clients’ expectations.

Resources